Saving Money in Havering This January

Saving Money in Havering This January

Navigating the Credit Crunch

Saving Money in Havering This January: Navigating the Credit Crunch – we are hoping to offer you some key advice for starting 2024!

Saving Money:

As the new year begins, many of us are looking for ways to save money and navigate the credit crunch. With rising costs of living and economic uncertainties, it’s essential to find practical strategies to stretch our budgets. We are going to explore expert advice and discover how his tips can help us save money in January. These money-saving tips are applicable to everyone in the UK but we want to make sure that everyone in Havering is well aware of the advice on offer.

Understanding the Credit Crunch:

The credit crunch refers to a period of economic difficulty with a lack of available credit and reduced consumer spending. It often leads to higher interest rates, limited access to loans, and increased financial stress for individuals and local businesses. Martin Lewis, the founder of MoneySavingExpert.com, has been a trusted voice during such challenging times. His expertise and practical advice can help us navigate the credit crunch and make smarter financial decisions.

Martin Lewis has become a household name in the UK for his money-saving expertise. His website, MoneySavingExpert.com, offers a wealth of information and resources to help individuals save money in various aspects of their lives. From reducing utility bills to finding the best deals on groceries, Martin Lewis provides practical tips that can make a significant difference in our monthly expenses. By following his advice, we can learn how to cut costs without compromising on our quality of life.

Saving Money on Everyday Expenses:

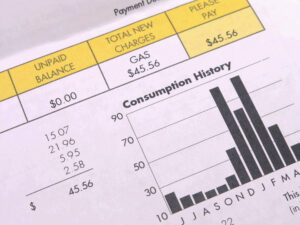

One of the key areas where we can save money is by reducing our everyday expenses. there are several strategies, such as switching to cheaper energy providers, using cash back websites for online shopping, and taking advantage of loyalty schemes. By implementing these tips, we can lower our monthly bills and have more money left in our actual pockets. The importance of budgeting and tracking our expenses to identify areas where we can make further savings is very key to keeping track of this.

Cost of Living in Havering:

While the cost of living may vary depending on the location, the principles of saving money remain the same. Romford, a vibrant town in Havering, has its own unique challenges when it comes to expenses. By being mindful of our spending habits, comparing prices, and seeking out the best deals, we can effectively manage our finances and save money regardless of where we live.

As a local community in Havering we are all navigating this time of life together and shopping local with trusted businesses will help give you peace of mind with quality control and value for money.

Long-Term Financial Planning:

In addition to immediate savings, the importance of long-term financial planning needs to be considered. This includes setting financial goals, creating an emergency bank fund, and investing wisely. By taking a proactive approach to our finances, we can secure our future and be better prepared for any economic uncertainties that may arise.

In addition to immediate savings, the importance of long-term financial planning needs to be considered. This includes setting financial goals, creating an emergency bank fund, and investing wisely. By taking a proactive approach to our finances, we can secure our future and be better prepared for any economic uncertainties that may arise.

Saving money in January and navigating the credit crunch may seem challenging, but with the guidance from experts such as Martin Lewis as well as openly discussing with close friends and family for tips will make things more manageable. By implementing practical tips and advice, we can make significant savings on everyday expenses, regardless of our location, whether it’s in Havering or beyond.